- LatAm VC

- Posts

- Sumer: Building the Shopify for Latin America

Sumer: Building the Shopify for Latin America

How a trio of ex-Rappi leaders unlocked 12X year over year revenue growth in a $700B Latin American e-commerce market.

An Overview

I first met Sumer Co-Founder and CEO Joaquín Serrano as he was kicking off the company’s seed round fundraise in late 2021, and was impressed by his operating experience at Latin American unicorn Rappi, his vision for Sumer, and his humble demeanor.

Based in Bogotá, Colombia, Sumer is on a mission to unlock e-commerce growth for SMBs across Latin America. The company has raised $10.3 million to date from 8VC, Mantis VC (The Chainsmokers), Streamlined Ventures, Susa Ventures, and others to empower 50 million SMBs across LatAm to launch and monetize their e-commerce presence in a matter of seconds.

Sumer has grown revenue by 12X year over year.

Sumer Co-Founders Oscar Arellano, Joaquin Serrano, and Yerson Cacua (source: Sumer)

Here are a few quick facts:

Team: co-founders are ex-Rappi finance and engineering leaders

Traction: over 6,000 paying merchants, projecting over 20,000 by the end of 2024

Investors: 8VC, Mantis Venture Capital (The Chainsmokers), Streamlined Ventures, Susa Ventures, Marathon Ventures, Rappi founders

Fundraising: Plans to raise Series A in 2024

Talent: hiring designer, FE developer, business intelligence analyst, UX analyst

I was fortunate to participate in the company’s seed round as an angel investor, and subsequently witness Joaquín and the Sumer team’s resilience in realizing their vision. They’ve since arrived at an inflection point of product-market-fit in late 2023, and are now gearing up for growth in 2024.

I’m excited to share their story with you.

Right Boss, Right Time

Joaquín once aspired to become a powerhouse investment banker — the “next Jamie Dimon,” he says.

Sumer Co-Founder and CEO Joaquin Serrano

After graduating from Universidad de Los Andes in Bogotá, Colombia, he joined a real estate investment firm called Credicorp Capital. At Credicorp, Joaquín was learning quite a bit. But he desired to create something more impactful and hands-on. He would soon have this chance.

In the summer of 2016, his boss, Oscar Herrera, received a call from the CEO of Rappi, then a fast growing Colombian delivery startup only one year old, to be the company’s CFO.

Oscar seized the opportunity and asked Joaquín to join him.

Rappi delivery bikers in Colombia (source)

Early Rappi Days: A Culture Built on Hustle and Community

There were no tables and chairs at the Rappi office, just a concrete floor. But no one minded.

Instead, they were relentlessly focused on shipping product and hitting numbers. “In the spirit of a startup, we were brothers in the trenches,” said Joaquín. “That was super important to me.”

This sense of camaraderie during the early days of Rappi — now a $7 billion superapp providing on-demand purchasing and delivery services for over 50,000 businesses and over 10 million users across Latin America — is a common narrative amongst dozens of entrepreneurial Rappi alumni now leading their own startups.

Community is clearly core to the Rappi leadership team’s DNA.

Rappi early days: (left to right) Joaquin Serrano (Sumer Co-Founder), Andrés Velez (Tributi Founder), Fabian Gomez "Fancho" (Frubana Founder), Felipe Villamarin (Rappi Co- Founder), Oscar Herrera (Rappi CFO) (source: Sumer)

Of Joaquín’s experiences over 5 years at Rappi, several were particularly memorable. Funding rounds, for example, were both exhilarating and exhausting. Joaquin and Oscar would take turns in relays — or “relevos” in Spanish — working on spreadsheets for Sequoia Capital’s due-diligence process.

One would grind until 2AM and then take a nap on a bench, while the other subbed in. During these periods, Joaquin would spend a lot of time picking the brain of Simón Borrero, Rappi’s Co-Founder and CEO. More than any other startup in Latin America at the time, says Joaquín, Rappi provided the possibility to work hand-in-hand with the “crème de la crème” of entrepreneurs.

Sequoia would go on to lead Rappi’s $52.8M Series A (noted as Series B on several platforms such as Crunchbase).

As a member of the Rappi team, it wasn’t important where or what you studied. “We had psychologists doing product,” said Joaquín, because they “knocked it out of the park in the interview and showed potential.” Furthermore, Rappi wasn’t looking at the pedigree of your education.

“At Rappi, we didn’t care whatsoever if you came from the Harvard of Latin America.” - Joaquín

This mindset was pioneering at the time for Latin American entrepreneurship — you could make your own path if you were entrepreneurial and hungry enough. At its essence, the Rappi culture unlocked upward mobility.

Inspired by this philosophy around startup culture, Joaquín was set on replicating it in his future entrepreneurial endeavors. He believes other members of the ‘Rappi Mafia’ — founders that have spun out of Rappi — feel similarly.

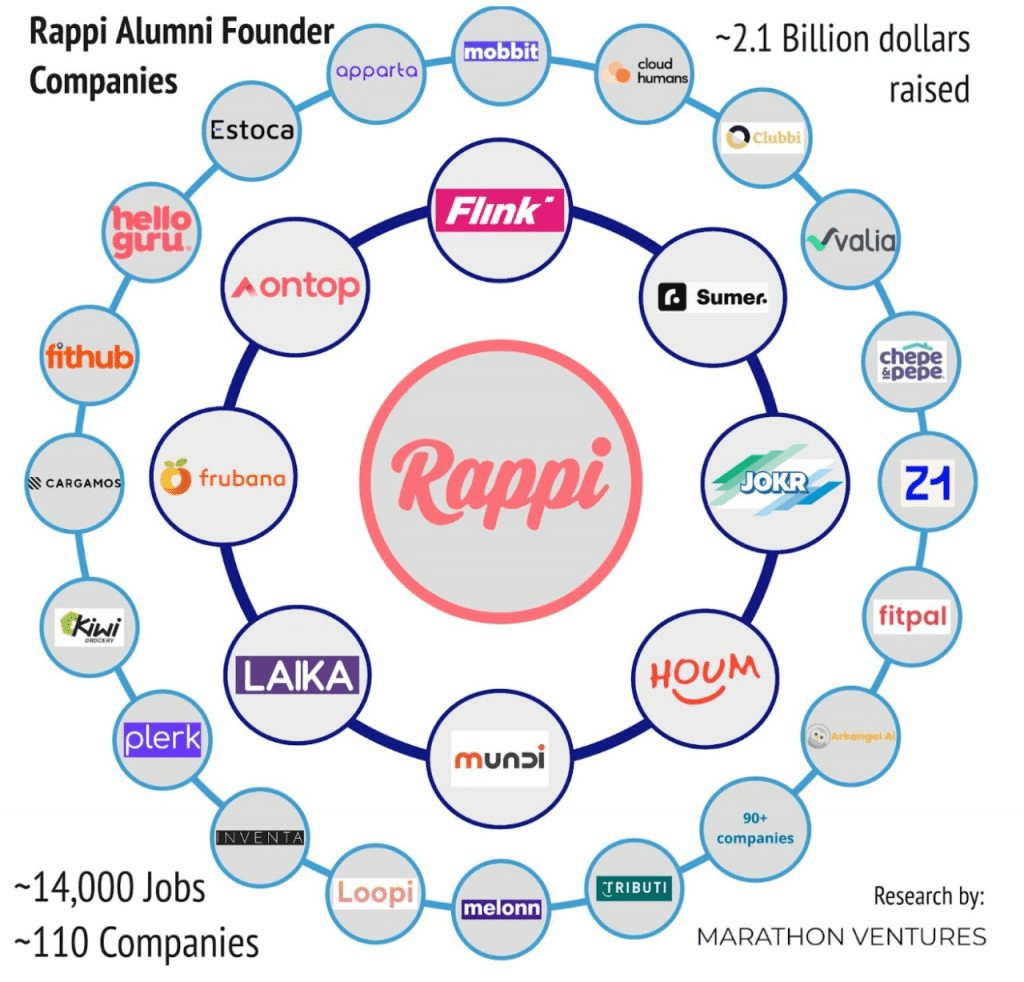

Rappi alumni have since raised over $2.1 billion for their own tech startups.

Rappi alumni companies have generated over 14,000 new jobs (source)

Meeting his Sumer Co-Founders

Joaquín met his co-founders, Yerson Cacua and Oscar Arellano, early in his Rappi journey. Yerson and Oscar were core engineers at Rappi and close colleagues of the Rappi founders Simón, Sebastian Mejia, and Felipe Villamarin even prior to inception of the company itself.

Yerson was a software engineer at the Rappi founders’ prior company, Grability, before joining Rappi in 2015 and serving as VP of Software Engineering.

Meanwhile, Oscar was a backend developer at Grability before joining Rappi, and soon became one of the most essential engineering leaders at the company, managing Rappi’s core technologies including order creation and checkout.

Left to Right: Oscar and Yerson in the Rappi early days (source: Sumer)

At Rappi, Joaquín worked closely with both Yerson and Oscar to identify whether every product the company launched made sense, unit economics-wise. Over many sleepless nights together, the trio forged a close relationship.

All three Sumer co-founders have parents that are small business owners. Joaquín himself experienced firsthand how difficult it was for his parents to manage their business.

“It’s very difficult to be a small business owner in Latin America,” said Joaquín. “90% of the workforce is only generating 30% of the continent’s GDP, and until now the digital infrastructure just hasn’t existed to connect and accelerate your SMB.”

A trip to Los Angeles in 2017 would spark his inspiration to build better solutions for Latin American SMB owners. While in LA, Joaquin was awestruck to see Square tablets and terminals at merchants across the city. They were “an Apple-like product for an overlooked sector of the economy,” as Joaquin describes them.

“Why didn’t Colombia have those?”

Square Terminal and PoS (source)

He became obsessed with the vision of bringing a delightful, Square-esque experience to SMBs across Latin America.

Early Ideation: A Name Inspired by the World’s First Known Civilization

Five years into the Rappi journey, Joaquín credits Simón, Rappi’s CEO, for giving himself, Yerson, and Oscar the spark to build a new company solving infrastructural problems for SMBs.

The trio initially began to ideate around a similar approach to that of Square, facilitating payments for Latin American SMBs at the point of sale. Simon “destroyed” that idea, says Joaquín, but “he was right.”

At the time, Latin America already had Clip, a point of sale infrastructure platform for SMB commerce that was several years old. Clip has since raised over $450 million from firms like General Atlantic, Softbank, and Viking Global.

Mexican Point of Sale product Clip (source)

It was around then that inspiration struck for the name “Sumer,” after the Sumerians, the very first known civilization in Mesopotamia. The Sumerians invented their own language and built core infrastructure, such as irrigation canals, to support commerce.

Like the Sumerians, the Sumer co-founders sought to unlock growth through foundational technology, and as Simón advised, “bring technology to where there is none.”

By early 2021, Latin America had a variety of point of sale companies present including Clip, Sr. Pago (acquired by Konfio), Ualá, Mercado Pago, and more. But as SMBs prepared to go digital, the next step in the value chain was entirely blank space. As an SMB owner, what software levers did you have to scale your business online?

The pieces began to fall into place in mid 2021, nearly post pandemic.

Riding the wave of the pandemic e-commerce boom, Joaquín, Yerson, and Oscar honed in on an MVP for SMBs to launch their e-commerce storefront online. In June of 2021, they began developing a product that, in just a few seconds, allowed an SMB owner to launch their online store from their mobile phone.

With this MVP and the strength of their operating pedigree, Joaquín, Yerson, and Oscar went out for a Seed round, raising $2.1 million and then an $8.2 million extension from investors including 8VC, Mantis VC (The Chainsmokers), Streamlined Ventures, Susa Ventures, Marathon Ventures, the Rappi founders, and more.

Sumer co-founders and first hires in 2021 (source: Sumer)

From Overbuilding to Laser Focus

At first, the Sumer co-founders wanted to go after the entire 50 million SMB market in Latin America with an all-in-one solution. They were inspired by SuperApps being formed in Southeast Asia – particularly in India and Indonesia.

Superapps are an increasingly common phenomenon in Asia (source)

They hypothesized that SMB owners in Latin America would need an ecosystem of tools to manage their store, from SEO and content management to social media integrations, cart processing, financial management, and even bookkeeping. In their minds, there was a lot to build in order to provide a complete suite of functionality.

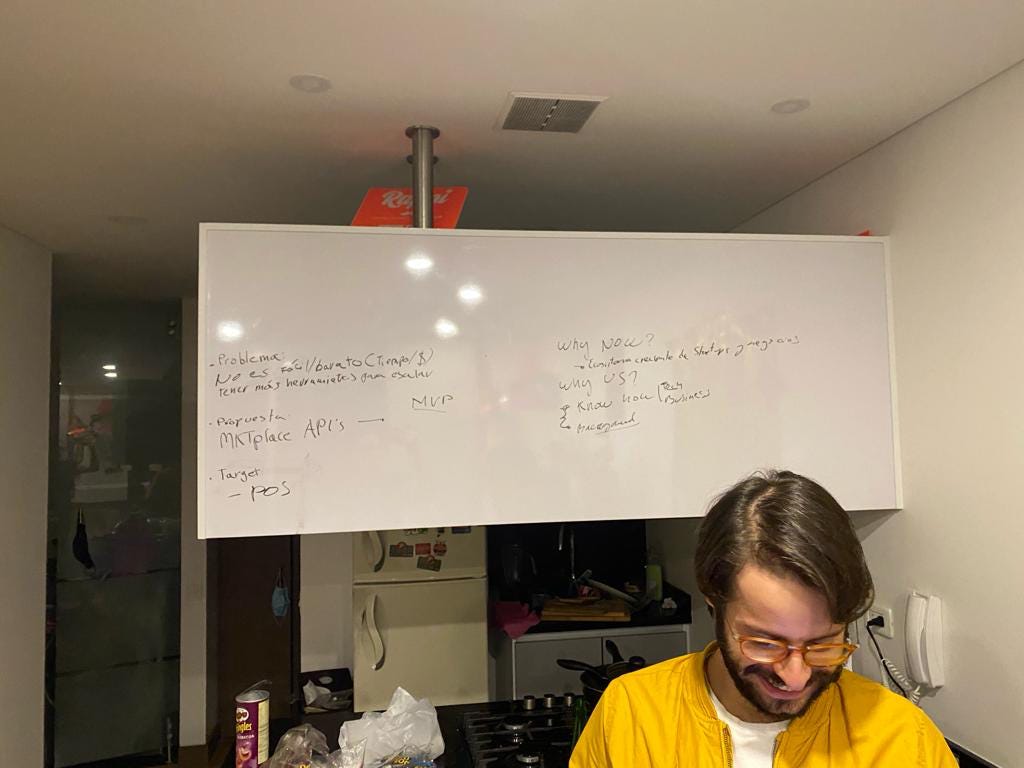

First doodles of the Sumer MVP in Oscar’s kitchen (source: Sumer)

However, they quickly discovered that within many SMBs, the customer persona they were dealing with was often someone running a side hustle. This persona had neither the purchasing power nor willingness to commit to a product like Sumer’s in the medium to long term.

Most importantly, for many initial users, the forcing function to adopt a specific segment of Sumer’s multi-faceted product was not strong enough; by going broad rather than deep, each individual component of Sumer’s product was serviceable… but not uniquely great.

The all-in-one narrative to grow your business “worked as an initial marketing hook,” says Joaquín, a signal of validation for the Sumer co-founders’ initial hypothesis around their perceived requirement for a complete suite of tools to be built in order to hit product-market-fit.

However, what this conclusion overlooked was the quality bar of each specific component in the app ecosystem required to drive user retention and truly differentiate.

“Initially, we were not focusing specifically on the right segment, and the right specific product for that segment,” said Joaquín. As a result, user engagement post acquisition was lukewarm.

Sumer Co-Founder Yerson Cacua (source: Sumer)

The team learned through six to eight months of MVP feedback that amongst thousands of problems an SMB owner experienced, one specific and critical objective stood out:

“How can I sell more?”

With this realization, Joaquin, Yerson, and Oscar resolved to focus on building a best in-class sales channel designed to enable SMBs to sell more, faster. And in mid 2022, Sumer doubled down on its e-commerce storefront functionality and deprioritized complementary services like bookkeeping.

Unpacking the Product

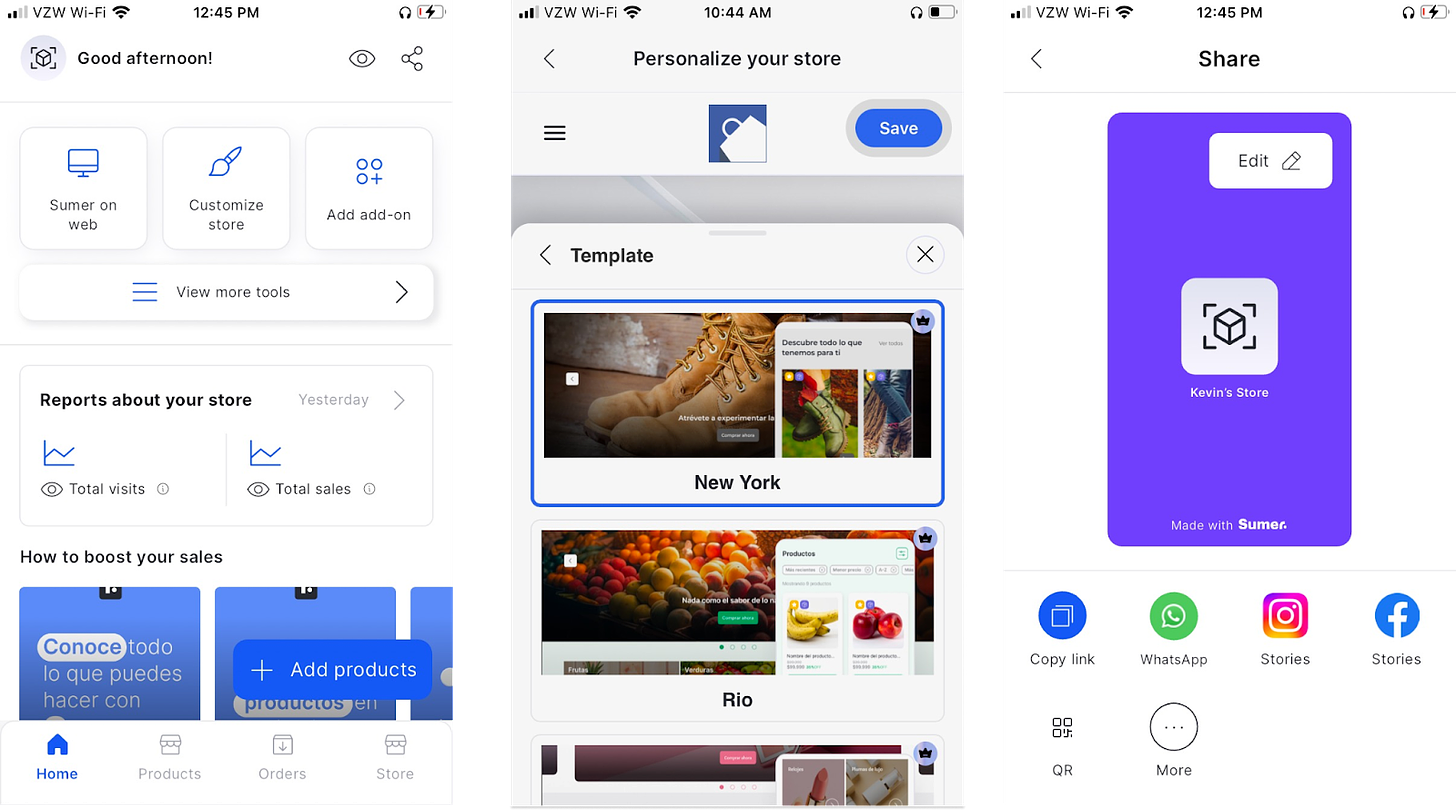

On Sumer today, SMB owners can create and design their storefront in seconds, from Android or iOS.

Sumer’s simple app interface is focused on speed (source: Sumer)

I ran through the process myself to test it out, with KPIs being the clicks and time it took to go from sign up to storefront launch.

First click – I selected a storefront template from a range of mobile-optimized options. I also had readily accessible options to adjust colorways, logos, and page structure.

Second click – arrive at a page to share my storefront directly via my social channels such as WhatsApp, Instagram, Facebook, or TikTok, and instantly begin driving conversions.

I also immediately noticed a readily accessible set of advanced customizations, such as electronic payments, analytics, and logistics, and the ability to add them instantly — no need to consider 10 different providers and understand which option was more suited. However, understanding and configuring this functionality was not a prerequisite to launch.

Ultimately, I was able to generate a shareable online store in just two clicks. Refreshingly simple. 😌

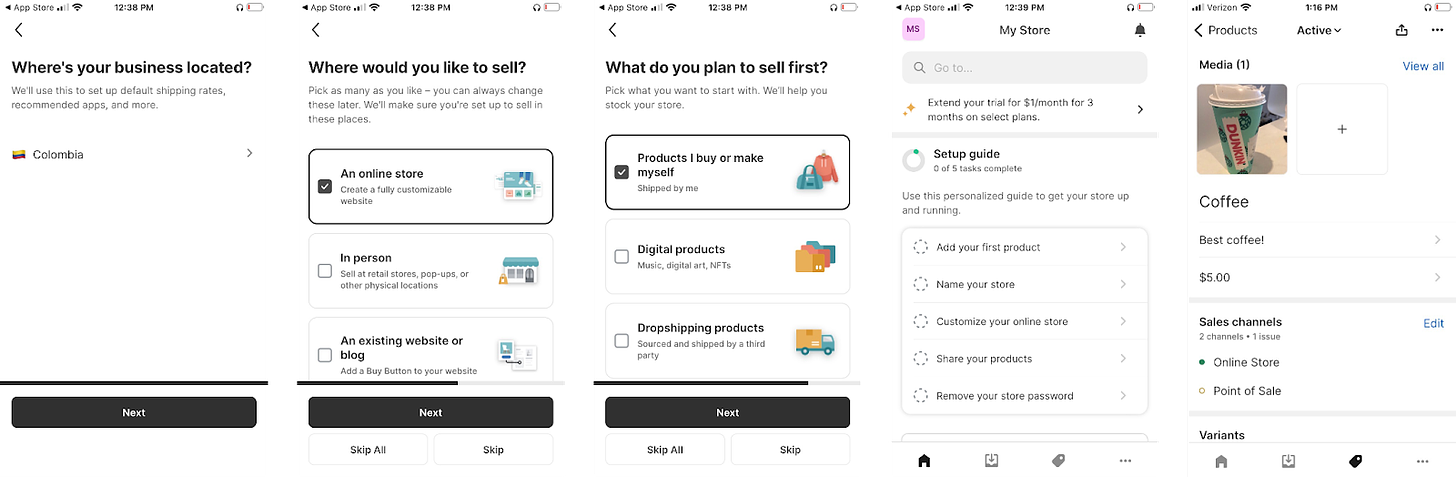

For comparison, I then ran through the Shopify app experience with the same KPIs: how quickly, and with how many clicks, could I launch and share my storefront.

I found that Shopify’s mobile store creation flow involves a series of required steps, from adding your first product(s) and customizations to naming your store and other operational tasks. Overall it required over 10 clicks to actually access the ability to share my store.

Shopify’s app is focused on breadth of customization and operational management (source: Shopify)

My overall takeaway on the Shopify app is that it provides a powerful range of tools that may be beneficial for full-stack business management, including brands with both digital and physical retail. I was particularly intrigued by the ability to integrate directly with Shopify’s Point of Sale system.

Shopify also provides over 8,000 various applications in its app store that cover every facet of SMB management, from live customer chatting to loyalty and rewards.

The Shopify App Store (source: Shopify)

However, in terms of sheer speed for a merchant aiming to launch their online store fast, from their mobile phone, Shopify left a lot to be desired.

Differentiating From Shopify and Wix

Joaquín echoes this sentiment, emphasizing Sumer’s focus on speed. Through their research, the Sumer team has found that in Latin America, SMB owners seeking to bring their business online have generally been hiring third party agencies to set up Shopify or Wix, paying approximately $1,500 for that service.

Furthermore, rather than building for brands that require a full suite of functionality to support both physical and digital operations, Sumer plans to differentiate further by focusing specifically on the 20 million person segment of non-technical, fast-moving SMB owners in Latin America that are specifically selling through Instagram from their phone.

This demographic has generally established an initial brand presence on Instagram and is running a legitimate business — one where their livelihood depends on the outcome — particularly in industries such as fashion, skincare, makeup, and accessories. These businesses may be in the early innings of setting up their e-commerce infrastructure and are currently shipping products from their apartment, without a physical shop.

By leaning into speed and simplicity as Sumer’s core differentiators, along with working closely with local Latin American payment providers and e-commerce juggernauts like Mercado Libre, Joaquin believes his team can quickly capture market share in Latin America as SMBs come online over the next few years.

In a 2021 interview, when asked about what is most critical for e-commerce market entrants in Latin America, former Managing Director of Shopify LatAm, Gonzalo Pascual, echoed the criticality of simplicity:

“What is important for merchants is to have a very simple process, especially on the payment and shipping side.”

Recalibrating the Business

By late 2021, Sumer had quickly scaled to a team of 80. At the time, team size was a barometer of success for the founders. Particularly in Latin America, as Muni founder Maria Echeverri famously stated, hiring is “more affordable” in Latin America. And for some problems, it felt logically cheaper to Joaquín, Yerson, and Oscar to solve them with manpower.

However, in 2022, the founders scaled the team down to about 50.

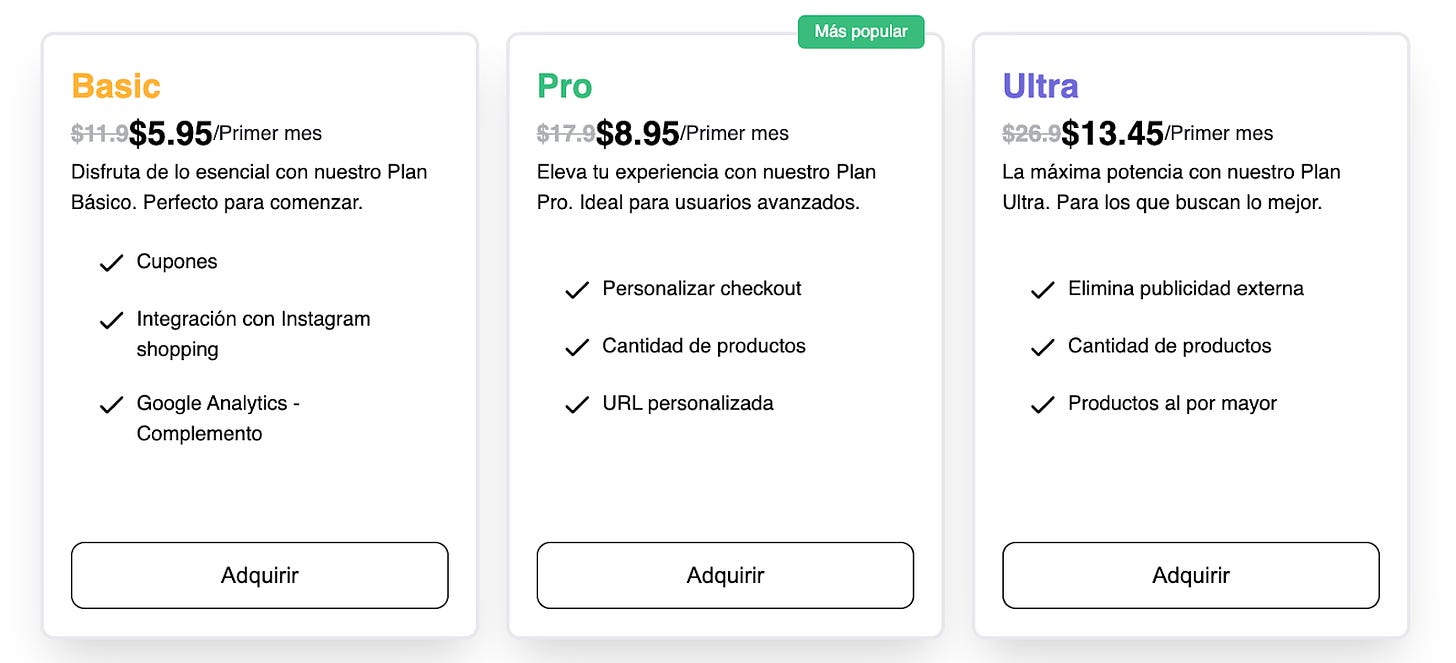

Furthermore, after starting with a metered payment model that included a commission on transactions, similar to Shopify’s revenue model, the Sumer team sought to simplify by evolving to a tiered subscription model:

Sumer offers three payment plans: Basic, Pro, and Ultra (source: Sumer)

That business model evolution was a gamechanger. In 2023, Sumer eclipsed mid six figures in recurring revenue at a 300% YoY growth rate, and aims to quadruple that amount in 2024.

Sumer currently counts over 6,000 paying merchants, and is projecting over 20,000 by the end of 2024.

For comparison, as of 2023, Shopify counts over 2 million merchants on its platform with annual GMV at around $220 billion and annual revenue at about $7 billion, growing 30% year over year, with approximately 71% of its revenue coming from North America and a healthy portion of the remainder coming from Europe.

Subscriptions contribute to approximately 30% of Shopify’s revenue, with other premium features including app sales, domain name registration, and other variable platform fees.

The company’s public market cap currently sits at around $92 billion, as a leader in the global $3 trillion TAM e-commerce market that is expected to grow to almost $7 trillion by 2025.

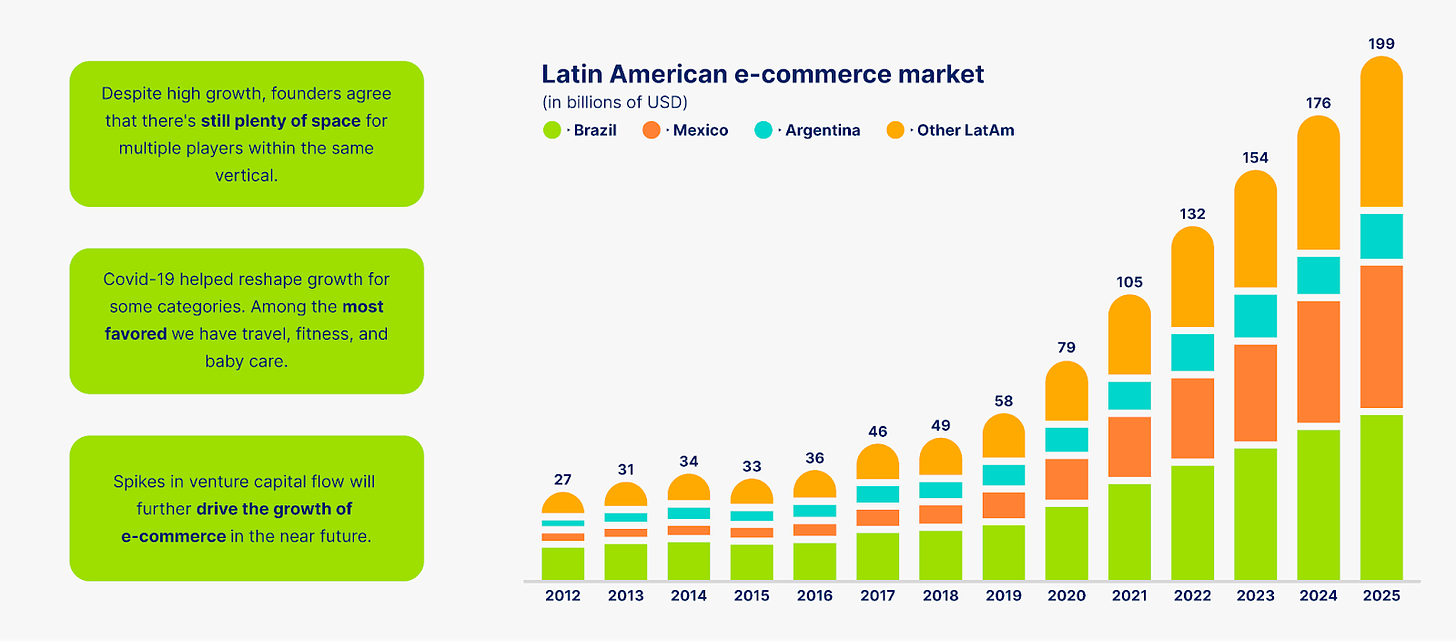

Within Latin America, however, e-commerce is a particularly fast-growing and untapped market — expected to grow 22% year over year to $700 billion by 2026, with Brazil, Mexico, and Colombia comprising the largest markets.

Latin America is the fastest growing e-commerce market in the world (source)

Meanwhile, e-commerce penetration in Latin America is expected to grow to about 16% by 2025 and to over 50% in the next decade.

The market is ripe for a local entrant like Sumer that fundamentally understands the dynamics of Latin American SMBs.

Gearing Up for Growth in 2024

Given emerging signals of product-market-fit, the Sumer founders are now focused on metrics-driven growth heading into 2024.

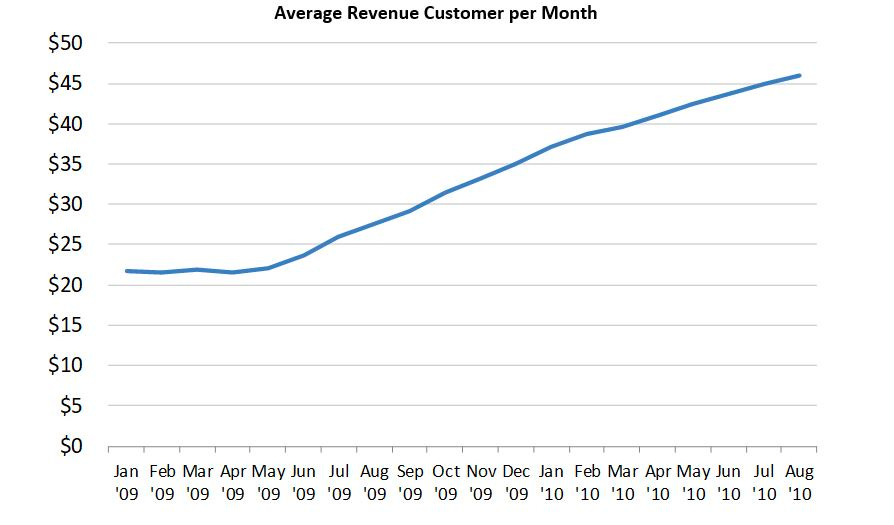

On one hand, they’re driving average revenue per user (ARPU) via nimble testing of bundled features. The team has nearly doubled Sumer’s average revenue per user (ARPU) since May of 2023, with a goal to exceed $15 to $20 by next year.

For reference, Shopify is generating an ARPU of around $92. To caveat, however, Shopify is an incumbent selling a suite of functionality into a predominantly North American market with greater purchasing power. And of course, Shopify is over 17 years old.

I dug up an investment memo by Bessemer Venture Partners from 2010, which illustrates Shopify’s ARPU development that year — Shopify started 2009 at around a $22 ARPU and doubled it over a year and a half. Bessemer ended up investing in Shopify’s 2010 Series A round.

Shopify ARPU growth from 2009 to 2010 (source)

On the other hand, Sumer is simultaneously employing a multi-channel customer acquisition strategy to reduce customer acquisition costs (CAC); the team has already cut CAC by more than half since the first quarter of 2023.

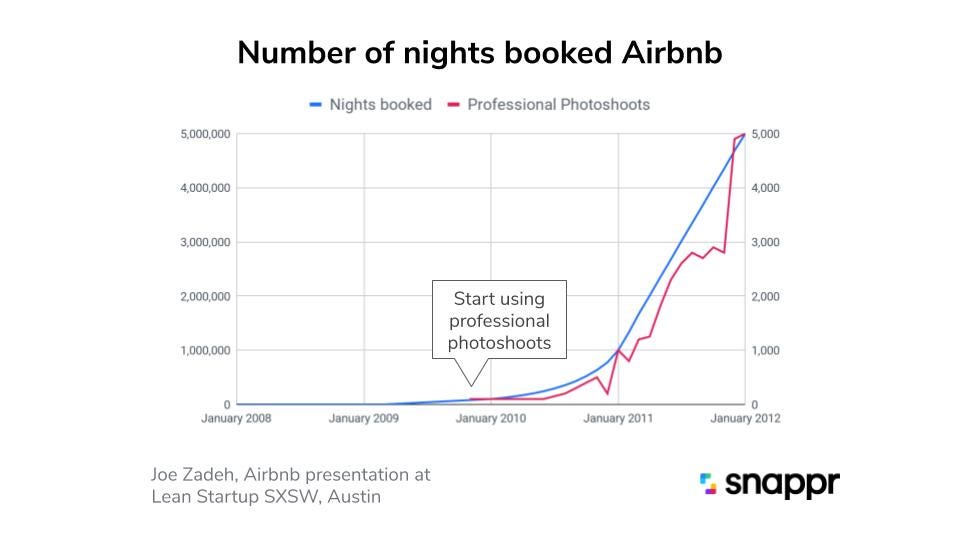

In tandem with this strategy is an emphasis on running nimble experiments to potentially unlock outsized merchant acquisition. Joaquín cites Airbnb as an inspiration in this regard. In 2009, Airbnb’s leadership realized that by taking high quality photographs of properties listed on Airbnb, their bookings would skyrocket.

Airbnb famously began using professional photoshoots in 2010, unlocking exponential booking growth (source)

What is Sumer’s secret sauce to executing on metrics-driven growth while simultaneously having the capacity to run these tests?

Joaquín credits Sumer’s product and engineering leadership — both in their ability to outpace the market with development speed, as well as their foresight to architect the platform in a highly-modular format that enables bundling of various features to quickly and precisely test hypotheses.

Sumer acquired Brazilian e-commerce startup Preki (YC W21) in Q3 of 2023 (source)

Big Vision: Winning the Latin American E-commerce Market

Joaquín and his team are optimistic about their prospects in Latin American. The “fundamentals are incredibly strong,” he says. Indeed, given Latin America’s GDP per capita, fintech penetration, cultural similarities, and shared language, tailwinds are in Sumer’s favor for rapid expansion.

First, however, the Sumer founders are setting their sights on eclipsing a seven figure run rate in Q1 of 2024, along with an emphasis on investment in AI to automate operational workflows for merchants.

________

Disclaimer: All information contained on LatAmVC is not intended as, and shall not be understood or construed as, financial advice. All views and ideas expressed are my own.

Disclaimer: I am an angel investor in Sumer.

Reply